Building an Insurance Portfolio for Car Collectors and Hobbyist Restorers

January 19, 2026Let’s be honest. That ’69 Camaro in your garage isn’t just a car. It’s a time machine, a piece of art, and a labor of love that probably knows the sound of your sigh better than your spouse does. For car collectors and hobbyist restorers, vehicles are assets of passion. And insuring passion? Well, that’s a whole different beast than your standard auto policy.

Think of it like this: you wouldn’t protect a priceless violin with a generic “musical instrument” policy from a big-box store. Your collection—whether it’s one meticulously restored classic or a stable of vintage racers—deserves a tailored shield. Building the right insurance portfolio isn’t about checking a box; it’s about safeguarding your investment, your history, and frankly, your sanity.

The Fatal Flaw: Relying on Standard Auto Insurance

Here’s the deal. A typical personal auto policy is built for daily drivers. It’s designed for depreciation, mileage, and the occasional fender-bender at the grocery store. For a collector car, this approach is, to put it mildly, a recipe for heartache.

Standard policies often use “Actual Cash Value” (ACV). That means they factor in depreciation. Try explaining to an adjuster that the 240Z you just spent three years and $40k restoring is, in fact, appreciating. You’ll likely get a check that wouldn’t cover the cost of the engine block. The mismatch is glaring.

Key Gaps in Everyday Coverage

- Agreed Value vs. ACV: This is the big one. Without an “Agreed Value” policy, you and the insurer are never on the same page about what the car is worth.

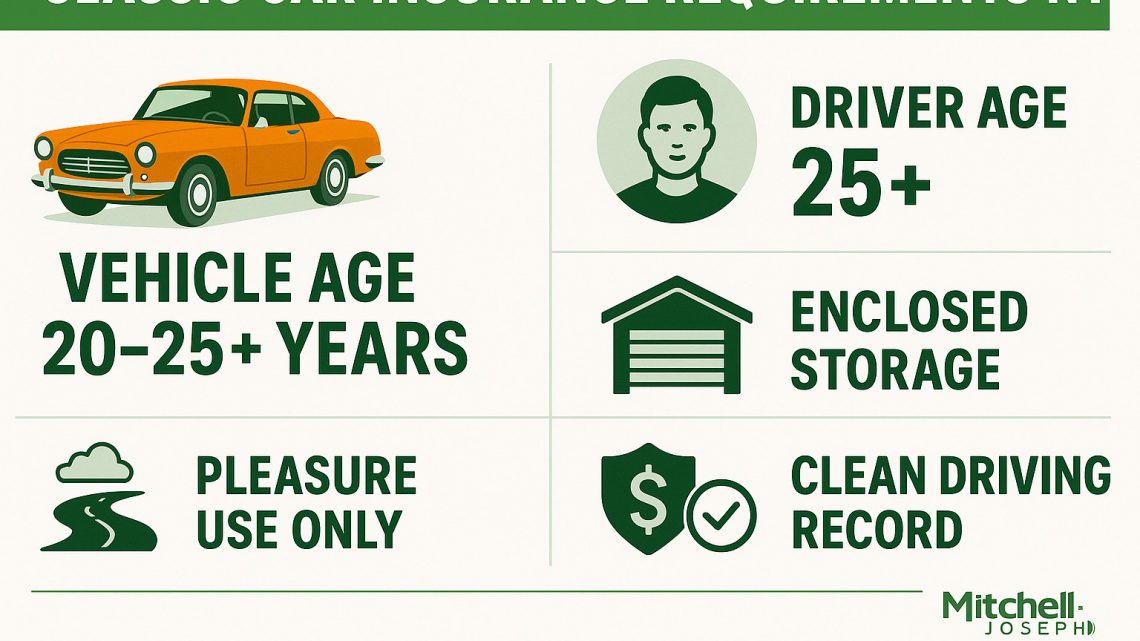

- Usage Restrictions: Most collector policies have mileage limits, but that’s a feature, not a bug. It ensures your car is used for pleasure, not commuting, which drastically lowers risk.

- Parts & Labor Realities: Finding a ’57 Chevy fender isn’t like ordering a part for a 2023 sedan. Specialized repair and rare parts sourcing aren’t in a standard policy’s vocabulary.

- The “Project Car” Problem: A disassembled car in your workshop? To many insurers, that’s just a pile of expensive parts with no coverage at all.

Crafting Your Custom Insurance Portfolio

So, how do you build a portfolio that actually fits? You layer it, like a well-tuned carburetor. Each component addresses a specific risk. Let’s dive into the core pieces.

1. The Cornerstone: Agreed Value Collector Car Insurance

This is non-negotiable. You and the insurer agree on the car’s value upfront, often backed by appraisals or documented receipts. If there’s a total loss, that’s the amount you get. No haggling, no depreciation nonsense. It provides peace of mind that’s worth its weight in gold—or in this case, polished chrome.

2. Coverage for the “Unfinished Symphony”: Restoration Projects

This is a major pain point for hobbyists. Specialized insurers offer “Restoration Insurance” or “Parts-in-Process” coverage. It can protect the vehicle and its components while it’s in pieces. Some policies even allow you to increase the agreed value in stages, as you complete major phases of the work. It acknowledges that your project has value long before it turns a wheel under its own power.

3. Beyond the Metal: Liability & Storage

Your portfolio must look beyond just damage to the car itself.

- Garage Liability: If a visitor gets hurt in your workshop or your lift fails, this protects you. It’s crucial.

- Storage Considerations: Is your garage detached? Does it have specific security features? Mentioning these can often lower premiums. Some policies even require locked, private storage—a good practice anyway.

- Event Coverage: Planning to show the car or take it on a rally? Make sure your policy covers these activities. Some include it automatically; others offer an endorsement.

Navigating the Appraisal & Documentation Maze

Proving value is your responsibility. And in this world, documentation is king. A folder of receipts isn’t just organized; it’s financial defense.

| Documentation Type | Why It Matters |

| Professional Appraisal | The gold standard. Especially vital for high-value, rare, or fully restored vehicles. |

| Photographic Timeline | Photos from barn find to finished showpiece. They tell the story and prove condition. |

| Receipts for Parts & Labor | Every nut, bolt, and specialist’s invoice. This builds the monetary case for your agreed value. |

| Historical Documentation | Original manuals, build sheets, ownership history. It adds provenance and authenticity. |

Honestly, treat this paperwork like part of the restoration. It’s just as important as the bodywork.

Common Pitfalls (And How to Steer Clear)

Even with the best intentions, collectors make mistakes. Here are a few to avoid.

- Underinsuring to Save a Few Bucks: Skimping on agreed value or skipping garage liability is a catastrophic risk. The premium savings are never worth the potential loss.

- Forgetting to Update Values: The market for classics isn’t static. That car you insured for $60k in 2019 might be worth $85k now. Annual review is a must.

- Assuming “Collector” Means “Never Driven”: You know, most good policies encourage you to drive and enjoy the car—within reasonable limits. They just want to know how, and how much.

- Not Asking “What If?”: What if a rare, NOS part is stolen from your bench? What if a fire damages the car mid-restoration? Ask your agent these gritty questions.

The Finish Line: More Than a Policy, a Partnership

In the end, building a robust insurance portfolio for your collection is an active process. It’s not a “set it and forget it” task. It requires an insurer who gets it—who understands that a scratch on a concours-winning paint job is a different kind of trauma than a dent in a commuter car’s door.

Look for companies that specialize. Ask fellow collectors for referrals. Find an agent who asks about your restoration timeline, your storage setup, your driving plans. That curiosity is a sign they see the whole picture.

Because your portfolio isn’t just a bundle of documents. It’s the safety net that lets you fully enjoy the hunt, the restoration, and the open road—knowing that the legacy you’re preserving is protected, down to the last detail.