What You Need to Know About Auto Insurance

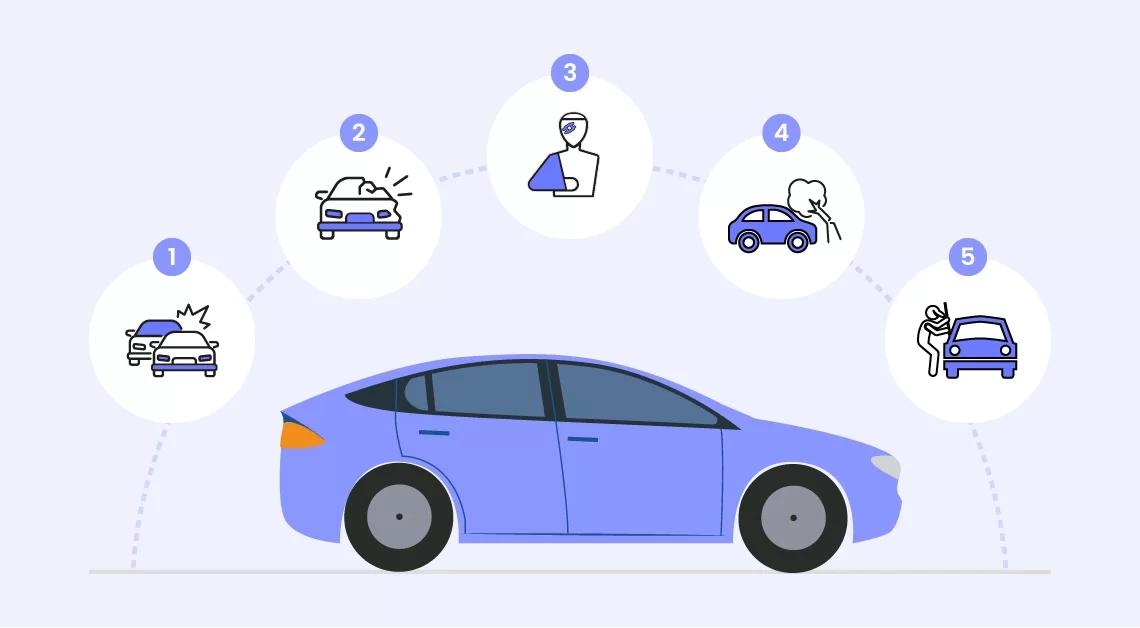

January 25, 2023Auto insurance is a type of insurance that helps you protect your vehicle and yourself from the financial risks of physical damage and bodily injury. Some of the coverage you can choose from are collision, liability, comprehensive, medical payments and gap insurance.

Liability coverage

Liability coverage is one of the most important components of an auto insurance policy. It protects the driver from a third-party claim in the event of an accident. However, it also comes with a number of nuances.

There are many variables that affect the cost of liability coverage. These include the value of your car, your driving record, and the location you live in.

Most states require drivers to carry liability coverage. The requirements vary by state, but the minimum limits range from one-half to one million dollars. Some experts recommend purchasing higher liability limits to ensure you’re covered if you get into an accident.

Choosing a higher limit is a good idea if you have a lot of assets. Similarly, if you have a lot of loans or other financial obligations, you may need to purchase full coverage.

Collision coverage

Collision coverage on auto insurance helps to protect you from having to pay for repair costs after a car accident. Depending on the situation, it may even help you replace your vehicle if it’s totaled.

Unlike comprehensive insurance, which pays for damage done to your vehicle, collision coverage will only pay out the cost of its current value. This can be as little as $1000. It’s important to determine the cost of your policy and evaluate whether or not you really need collision coverage.

The cost of collision coverage depends on many factors. Some insurers charge more than others. It’s also worth considering the age of your car. If it’s more than 10 years old, it’s probably not going to retain much value and might not be worth the extra expense.

Comprehensive coverage

Comprehensive coverage on auto insurance protects your vehicle from damages that cannot be avoided. It covers theft, animal damage, vandalism, fire, and natural disasters.

Depending on your insurer, comprehensive coverage may cost less than a few dollars per month. This is because comprehensive coverage usually includes a deductible. The amount of the deductible is a personal choice. If you choose a higher deductible, your premiums will be lower. However, you could end up paying more out of pocket if you are involved in an accident.

While comprehensive car insurance may be a good deal for newer cars, it may not be worth it for older ones. In addition, it is not always necessary. Whether or not it is worth the expense depends on how much your vehicle is worth.

Medical payments coverage

Medical payments coverage (MedPay) is a type of insurance that pays medical bills after an accident. It can help cover the cost of medical care, hospital expenses, and funeral expenses. However, it doesn’t cover all costs associated with an auto accident.

The amount of medical payments coverage you buy is up to you. You choose the maximum amount you want to pay for, and the insurer will only pay up to that limit.

There are two types of MedPay: primary and secondary. Primary coverage requires an applicant to pay a medical bill upfront. Secondary coverage covers deductibles and co-pays. If your health insurance is high-deductible, this can be a helpful add-on.

Medical Payments Coverage isn’t required by law in many states. However, it’s usually affordable.

Some companies charge as little as $10 a month for this type of coverage. In addition to paying for a doctor visit, it can also cover dental and prosthetic costs.

GAP coverage

Gap coverage for auto insurance is an optional insurance product that can be added to your existing policy or bought at the dealership. It pays for the difference in value between your car and your loan balance. The cost of gap insurance will vary based on your insurer and vehicle.

GAP coverage for auto insurance is an effective way to cover the financial loss of a totaled car. It’s also a good idea for drivers who finance new cars. However, it’s important to remember that gap coverage is only needed for a short period of time.

Typically, you only need to carry gap coverage until your car’s loan balance falls below the car’s value. This means that if your car is stolen or totaled, you will not have to pay your loan.